Maximizing Your ROI: The Chicago Landlord’s Guide to the Perfect Residential Lease

Being a landlord in Chicago is a unique experience. We have some of the most beautiful architecture in the world and a rental market that stays busy year-round, but we also have some of the most specific challenges. If you’ve ever tried to move a couch up a narrow flight of stairs in a three-flat during a January sleet storm, you know exactly what I mean.

Success in this city isn’t just about finding someone to pay the rent. It’s about timing, being clear with your expectations, and staying on the right side of the law. Because our city has such extreme seasons, a lease that begins in December can feel like a completely different asset than one signed in June. Here is how we look at the "Chicago cycle" to make sure your property is working as hard as it can for you.

Timing is everything in the Windy City

In Chicago, the "Leasing Season" is a very real thing. It isn’t just some marketing term we use. It’s a cycle driven by our lakefront weather and the school calendar. Moving during a blizzard is a rite of passage that nobody actually wants to experience. If you’ve lived here long enough, you’ve seen the "dibbs" chairs on the street and the moving trucks struggling to find a spot in a snowbank.

Your goal as a property owner is to have your leases end between March and July. This is the sweet spot. This is when the largest pool of renters is out looking for their next home. When you have more people looking at your unit, you get to be more selective. You can find the tenant who is the best fit for your building, and you can usually achieve the highest market rents because demand is so high.

But what happens if you find yourself with a vacancy in October? The common mistake is to just write a standard 12-month lease. If you do that, you’re just setting yourself up for another vacancy next October. Instead, we recommend a "bridge" lease. You could offer a 17-month or 18-month lease to push that expiration date back into that prime spring or summer window. You could also try a shorter 6-month or 7-month lease. That gives you the chance to raise the rent much sooner, though it does mean you’ll be doing the work of a turnover again in just a few months.

The strategy of the itemized lease

I’ve always found that being honest and clear at the start of a relationship prevents big headaches at the end. One of the best ways to do this is to break out your base rent from all the other costs of living in the building. Instead of giving your tenant one big lump sum, show them exactly what they are paying for.

Think about it like a receipt. Clearly identify the extras like:

Pet Rent: Usually a small monthly fee like $25 or $50 for each pet.

Utility Bundles: This covers things like water, trash, or perhaps gas if the building is set up that way. (As a rule of thumb, we suggest never covering utilities like electricity or heat if you can avoid it.)

Parking Fees: If your property has a dedicated spot, it should have its own line item.

Technology Services: This could include things like high-speed internet or a tenant benefit package.

Doing this protects your bottom line. If the city raises property taxes or the cost of trash pickup goes up, you can adjust those specific fees when the lease renews. You won't necessarily have to hit a great tenant with a massive jump in their base rent just to cover your costs. That kind of transparency builds trust. It also makes it easier to add or remove services later if the tenant’s needs change.

How to fix a "bad" leasing cycle

Maybe you just bought a property where the tenants are on a month-to-month plan, or perhaps you have a lease that is currently scheduled to end in the dead of winter. You aren't stuck there forever. You can actually incentivize your way out of it. We call this the "win-win" cycle fix.

The tactic is simple. You offer the tenant a shorter lease term to get the end date into that March–July window. For example, if their lease ends in December, you might offer them a 6-month extension. You could keep the rent exactly where it is, or even offer a small discount for those few months.

For the landlord, the win is huge. You avoid having an empty unit in January when nobody wants to move. You "reset" the property so that the next time you need a tenant, you're looking during the high-demand season. For the tenant, they get a little break on the rent and the massive convenience of moving when it’s 70 degrees outside instead of 10º.

Staying compliant with Chicago basics

Managing a rental here is just as much about the numbers as it is about following the rules of the city. Chicago has some very specific requirements you cannot afford to skip.

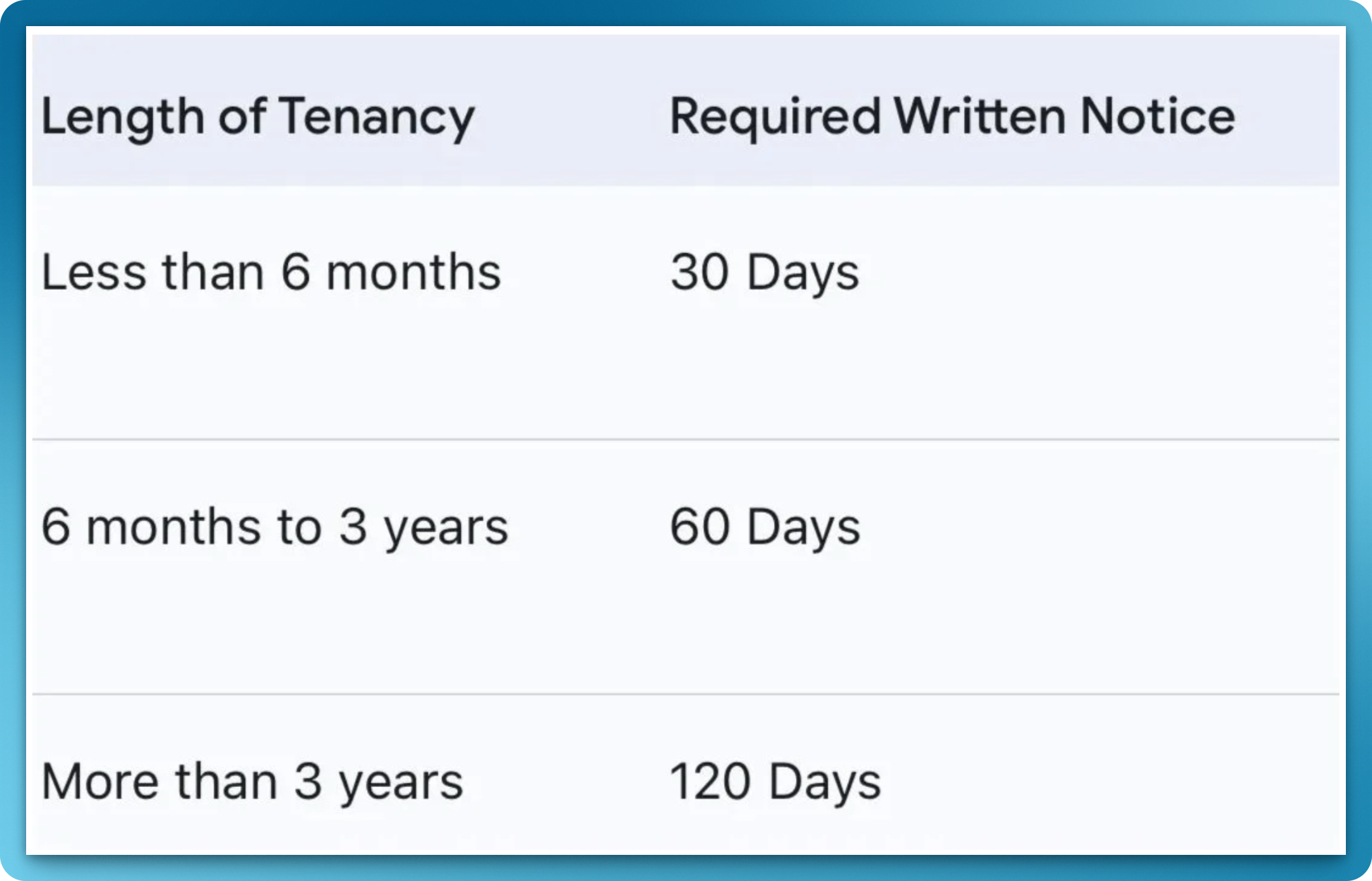

First, there’s the RLTO, or the Chicago Residential Landlord and Tenant Ordinance. You have to attach a summary of this ordinance to every single lease you sign. If you don't, it can cause major legal problems down the road. You also need to pay close attention to the timing of your notices. The city has very specific rules about how much notice you have to give if you plan to raise the rent or end a lease, and those rules change depending on how long the tenant has lived there.

Then there is the issue of security deposits. This is a big one. In Chicago, if you take a deposit, you have to follow incredibly strict rules about where that money is kept, how much interest it earns, and when you provide receipts. Even a small mistake here can lead to heavy fines. Because of this, many of the landlords we work with have moved away from security deposits entirely. Instead, they use a non-refundable "Move-In Fee." It is much simpler to manage and keeps you away from the legal traps that come with traditional deposits.

Getting your portfolio on the right track

At the end of the day, managing these cycles and staying on top of the "extras" is one of the most valuable things we do for our clients. If your leases are ending in the wrong months, you are essentially leaving money on the table every year.

We’ve been working in the Chicago market for a long time, and we’ve seen how these small adjustments in timing and transparency can change the entire trajectory of an investment. It takes some planning, but getting your leases synchronized with the rhythm of the city makes the whole process of being a landlord much more enjoyable.

If you’re feeling like your current portfolio is a bit disorganized, or if you just want someone to take a look at your "extras" to see if you’re capturing the right value, we’re here to help. You can reach out to Andrew Dorazio at info@bcgrealestategroup.com or andrew@doraziorealestate.com. We can sit down and look at your current leases and figure out a plan to get them moved into the right season.